Abstract

Financial stress predicts negative academic, social, and psychological outcomes in a tertiary student’s life. To investigate whether free first-year education could mitigate financial stress in New Zealand tertiary education students, 270 psychology students from the University of Canterbury completed scales measuring financial stress, perceived socio-economic status, and debt attitude as well as demographic status and financial status variables over a series of two experiments. The efficacy of the New Zealand government’s free first-year tertiary education policy on reducing students’ financial stress was investigated in contrast with taking a temporal discounting approach, i.e. putting less value on future gains: Half of the participants were primed with a paragraph regarding free first-year education. Students’ financial stress increased with increasing debt, inability to save money, and thinking that one’s weekly income was not sufficient for living needs, but objective financial status variables such as their income, receiving Student Allowance, and part-time employment were not associated with students’ financial stress. Priming with the government’s free first-year education policy did not decrease first-year students’ financial stress, indicating that the students were taking a temporal discounting approach. Overall, the findings suggest that 1) the government’s focus could usefully shift to students’ present financial concerns and 2) students’ financial counselling and financial management skills could be enhanced.

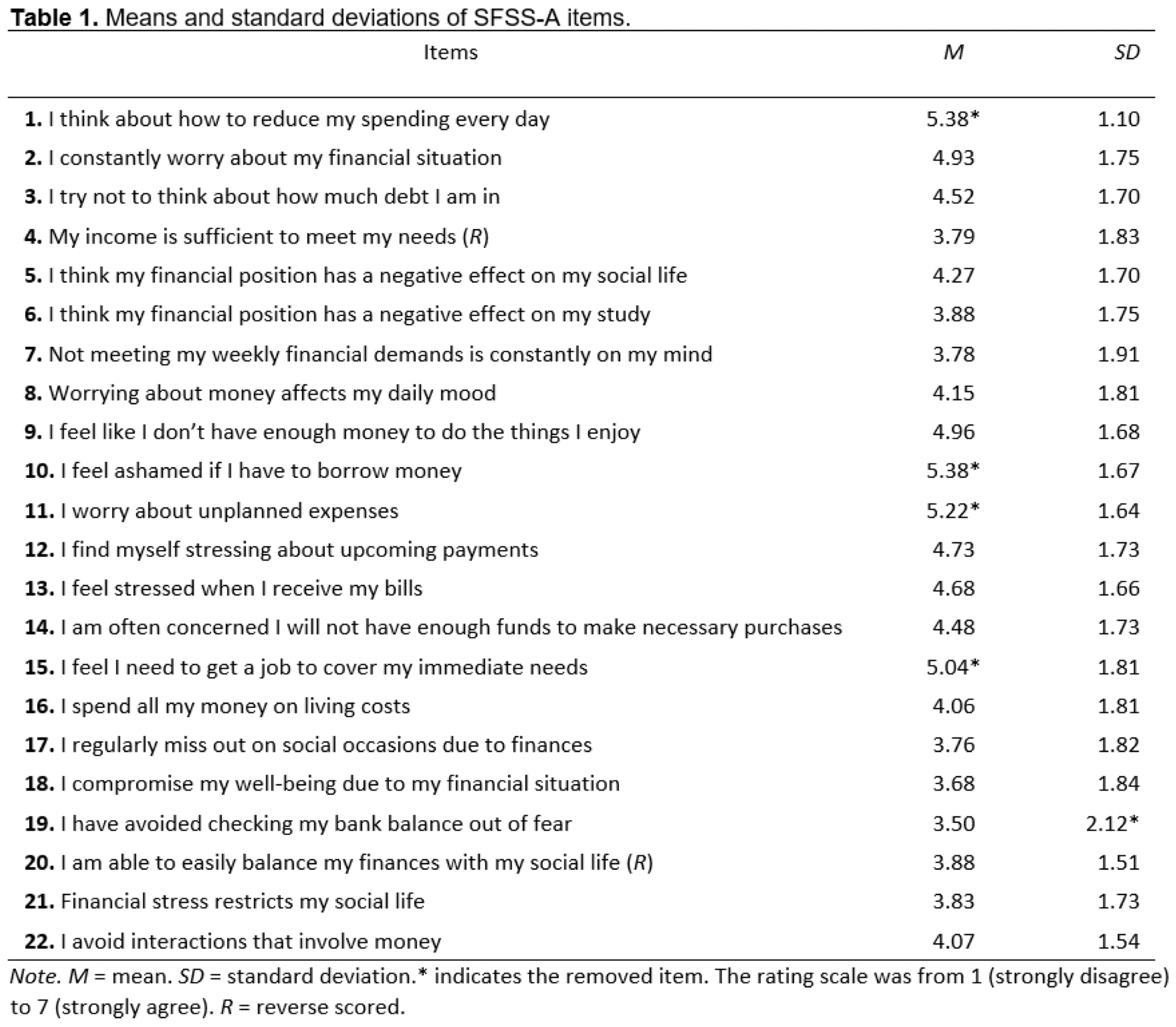

Important table

Table 1: Descriptives and items of the Students’ Financial Stress Scale – Aotearoa (SFSS-A).

Students’ Financial Stress Scale – Aotearoa (SFSS-A).Important figures

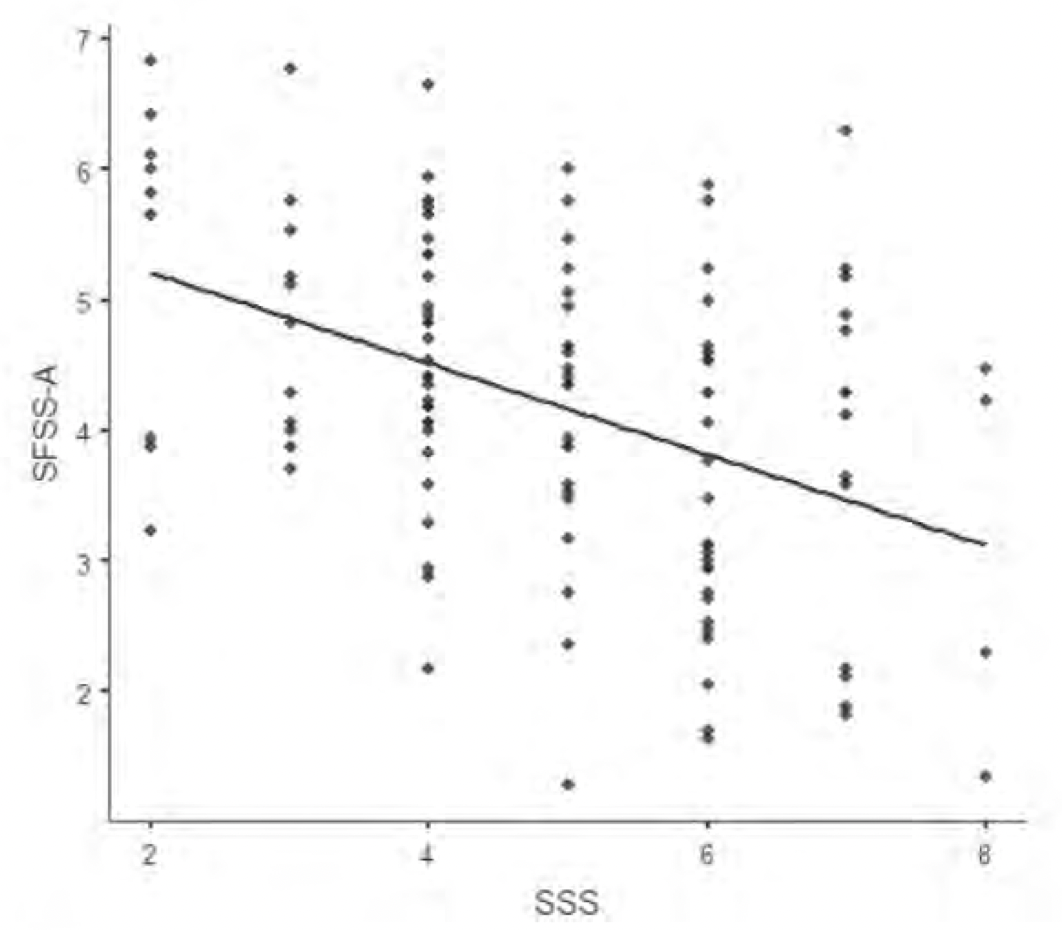

Figure 1: Relationship between SFSS-A and subjective social status scale scores in Study 1.

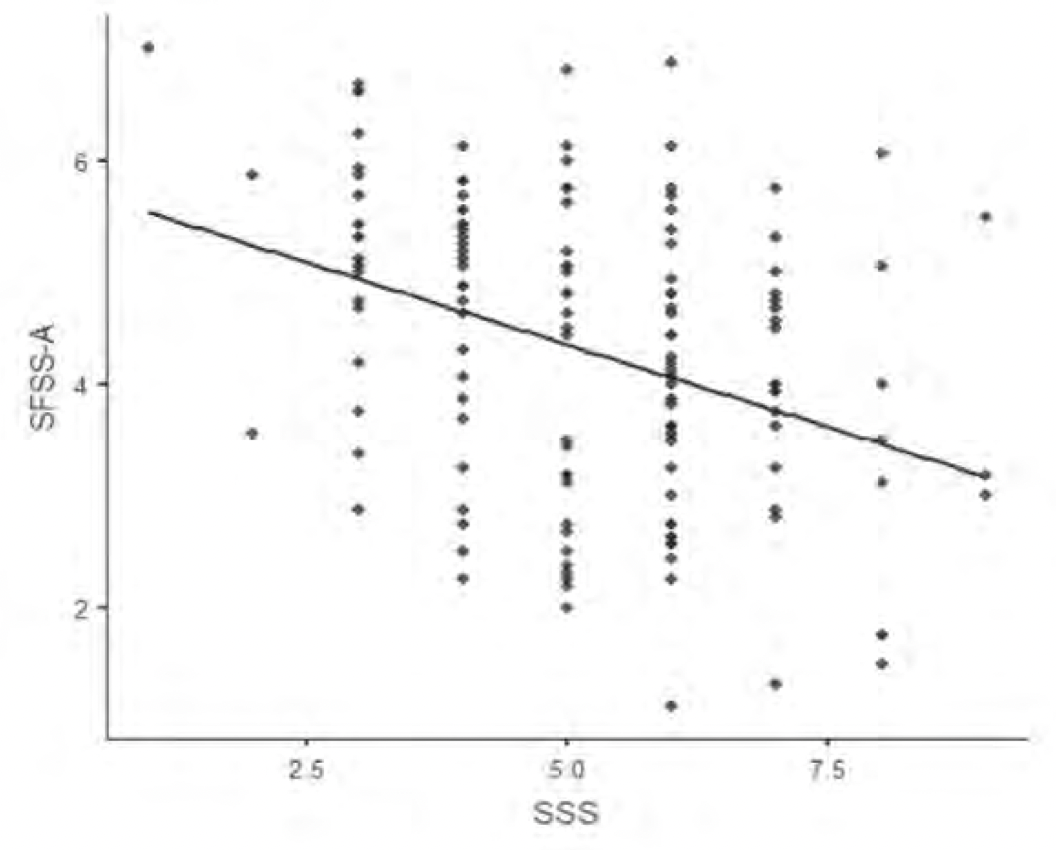

SFSS-A and subjective social status scale scores in Study 1.Figure 2: Relationship between SFSS-A and subjective social status scale scores in Study 2.

BibTeX citation

@article{afzali2020perception,

title={Perception of financial satisfaction and its implications for free first-year education in New Zealand university students},

author={Afzali, M Usman and Bustos, Julie Viviana Cede{\~n}o and Kemp, Simon},

journal={New Zealand Journal of Psychology (Online)},

volume={49},

number={2},

pages={4--14},

year={2020},

publisher={New Zealand Psychological Society}

}